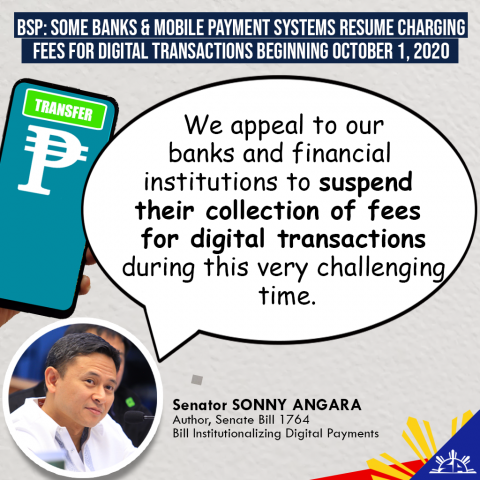

Senator Sonny Angara issued an appeal to the banks and mobile payment systems to suspend the collection of fees for digital transactions while the country is still dealing with the COVID-19 pandemic.

Several banks and mobile money services will resume their collection of fees today in spite of an appeal by the Bangko Sentral ng Pilipinas (BSP) for them to extend their waiver for PESONet and InstaPay transactions.

Angara aired his full support to the efforts of the BSP to promote the use of digital payments in order to reduce physical/cash transactions while also providing some relief to consumers during these extraordinary times.

“Right now every family is penny pinching due to the impacts of the COVID-19 pandemic so every peso saved goes a long way. We appeal to our banks and financial institutions to suspend their collection of fees for digital transactions during this very challenging time,” Angara said.

“Ang buong gobyerno ay gumagawa ng paraan para tulungan ang lahat ng sektor na tinamaan ng pandemiya. Ang waiver ng fees sa digital transactions ay maliit na bagay na makakabawas kahit paano sa mga pasanin ng ating mga kababayan,” he added.

The BSP has noted that several banks will resume charging fees for digital transactions this month, including some of the biggest commercial banks in the country.

Among the banks and mobile money services that will resume charging fees today are BDO Unibank, Inc.; Metropolitan Bank and Trust Company; Bank of the Philippine Islands; China Banking Corporation; Bank of Commerce; Robinsons Bank Corporation; Philippine Savings Bank; PayMaya Philippines, Inc; China Bank Savings, Inc.; Philippine Bank of Communications (extending its PhP 1.00 fee due to system constraints); and Equicom Savings Bank, Inc.

At least 12 banks have decided to waive their fees for PESONet and InstaPay transactions until December 31, 2020 based on a list released by the BSP last August.

These include Union Bank of the Philippines; Asia United Bank Corporation; Land Bank of the Philippines; Development Bank of the Philippines; Security Bank Corporation; Sterling Bank of Asia, Inc.; Standard Chartered Bank; East West Banking Corporation; United Coconut Planters Bank; Maybank Philippines, Inc.; Rizal Commercial Banking Corporation and Hongkong and Shanghai Banking Corporation (waived for retail; for corporate – reduced from P150 to P50 from 01 July 2020).

The following banks have agreed to waive their fees until further notice: Philippine National Bank; MUFG Bank, Ltd.; CTBC Bank (Philippines) Corporation; Bank of China Limited – Manila Branch; BPI Direct Banko; Cebuana Lhuillier Rural Bank; CIMB Bank; Citibank; DC Pay (retail clients); ING Bank N.V.; JP Morgan Chase Bank; Philippine Business Bank; Philippine Trust Company; Bank of Florida.

Angara has filed a bill promoting the adoption of digital payments for financial transactions of government and all merchants.

Senate Bill 1764 seeks to institutionalize digital payments in government and the private sector in order to improve efficiency, reduce costs and the possible health hazards posed by physical transactions.