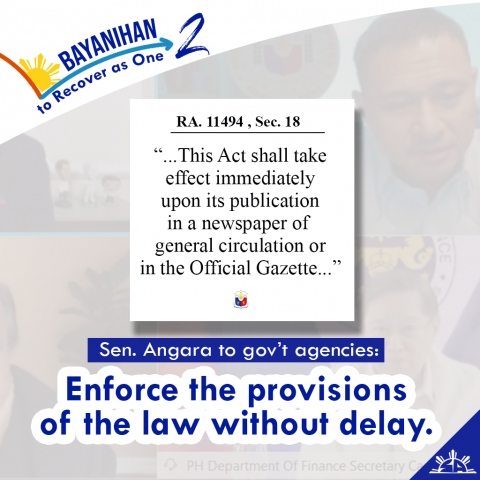

Senator Sonny Angara reminded all the government agencies involved in the implementation of Republic Act 11494 or the Bayanihan to Recover as One Act (Bayanihan 2) to enforce the provisions of the law without delay.

Addressing the Department of Finance (DOF) and its attached agencies during today’s budget hearing by the Committee on Finance, Angara reminded the agencies concerned that Bayanihan 2 became effective immediately after it was published September 15.

“We passed Bayanihan 2 and we put in there that it is immediately effective even without the IRR (implementing rules and regulations). But some of the stakeholders are still waiting for orders that are already enforced,” Angara said.

“Although the implementing rules are no longer needed for effectivity, I think they are waiting. BSP (Bangko Sentral ng Pilipinas) has issued an order but perhaps others like the Insurance Commission can issue compliance orders. That would be great for our borrowers and the affected sectors. Maybe we can remind them or inform them to issue these orders,” he added.

Section 18 of RA 11494 states that the law “shall take effect immediately upon its publication in a newspaper of general circulation or in the Official Gazette.”

During the bicameral conference committee meetings on Bayanihan 2, Angara noted there was an understanding among the members that an IRR was no longer needed for the implementation of the law.

Many government agencies and private entities have been hesitant in implementing the provisions of Bayanihan 2 as they sought for guidance in the form of an IRR.

Some agencies such as the BSP have already issued guidelines on the implementation of the pertinent provisions of Bayanihan 2.

In the case of BSP, it already issued a memorandum for all covered institutions to “implement a mandatory, one-time, 60-day grace period to all loans that are existing, current and outstanding, falling due, or any part thereof, on or before December 31, 2020.”

Under Bayanihan 2, the grace period covers loans, amortizations, premium, lease and credit card payments of all banks, quasi-banks, financing companies, lending companies, real estate developers, insurance companies providing life insurance policies, pre-need companies, entities providing in-house financing for goods and properties purchased, asset and liabilities management companies and other financial institutions, public and private, including the Government Services Insurance System, Social Security System and Home Development Mutual Fund.

Bayanihan 2 also provides for a minimum 30-day grace period for the payment of electric, water, telecommunications and other similar utilities bills that fall due within the period of ECQ and MECQ and a minimum 30-day grace period on residential and commercial rents.

Finance Secretary Carlos Dominguez III explained during the budget hearing that the DOF team has already submitted its draft IRR for Bayanihan 2 to Malacañang, a day after it was signed into law by President Rodrigo Duterte last September 11.

Dominguez said that he will ask Malacañang to “move ahead very quickly” in response to the appeal of Congress.

-30-

--

Media and Communications Group

Senator Sonny Angara